|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Process to Refinance Fixed Home Loan in Today's MarketIntroduction to RefinancingRefinancing a fixed home loan can be a strategic financial decision that may help reduce monthly payments, shorten loan terms, or free up cash for other investments. However, understanding the intricacies involved is crucial before proceeding. Reasons to Consider RefinancingPotential Financial Benefits

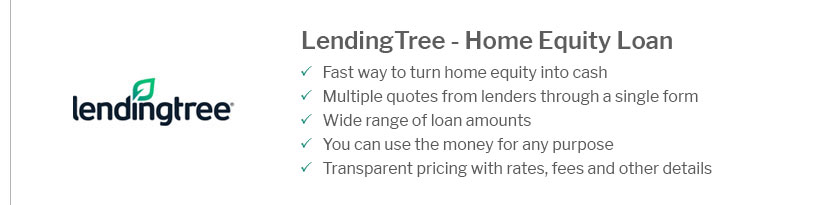

Accessing Home EquityRefinancing can also provide access to home equity, allowing homeowners to fund renovations, education, or other significant expenses. Steps Involved in the Refinancing Process

Things to Watch Out ForWhile refinancing offers numerous benefits, certain aspects require careful consideration:

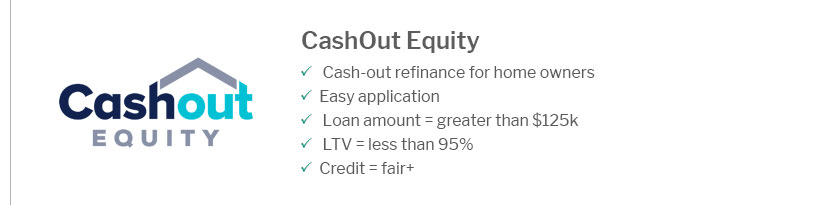

FAQsWhat is the typical cost of refinancing a fixed home loan?Refinancing costs generally range from 2% to 5% of the loan amount, covering application fees, appraisal, and other closing costs. How long does the refinancing process take?Typically, the refinancing process can take anywhere from 30 to 45 days, depending on the lender and the complexity of the application. Can I refinance my home loan with bad credit?Yes, refinancing with bad credit is possible, but it may come with higher interest rates. It's advisable to consult with lenders who specialize in such cases. https://www.bankofamerica.com/mortgage/learn/refinancing-fixed-rate/

Refinancing can be done for many reasons, but switching from an adjustable-rate mortgage (or ARM) to a fixed-rate ... https://www.usbank.com/home-loans/refinance/conventional-fixed-rate-refinance.html

Explore conventional refinance rates and features. With a fixed-rate home refinance you can enjoy a consistent rate and predictable monthly principal and ... https://www.reddit.com/r/personalfinance/comments/1arplge/can_you_still_refinance_on_fixed_house_loans/

Builder told me that they can lock fixed interet rate at 5.2%. Does that mean it's fixed at 5.2% until payoff? Can i stil refinance to lower rate if possible?

|

|---|